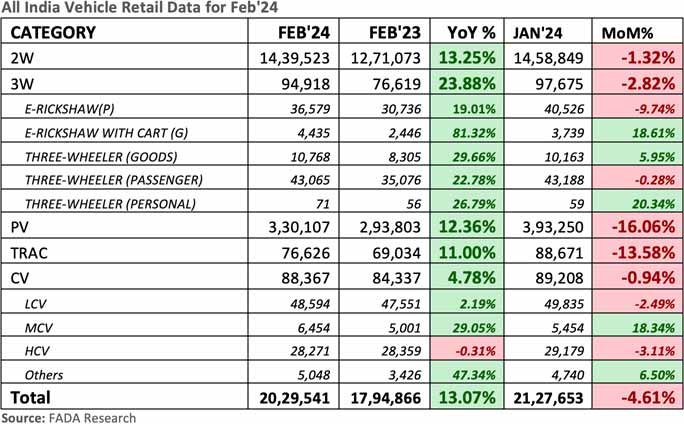

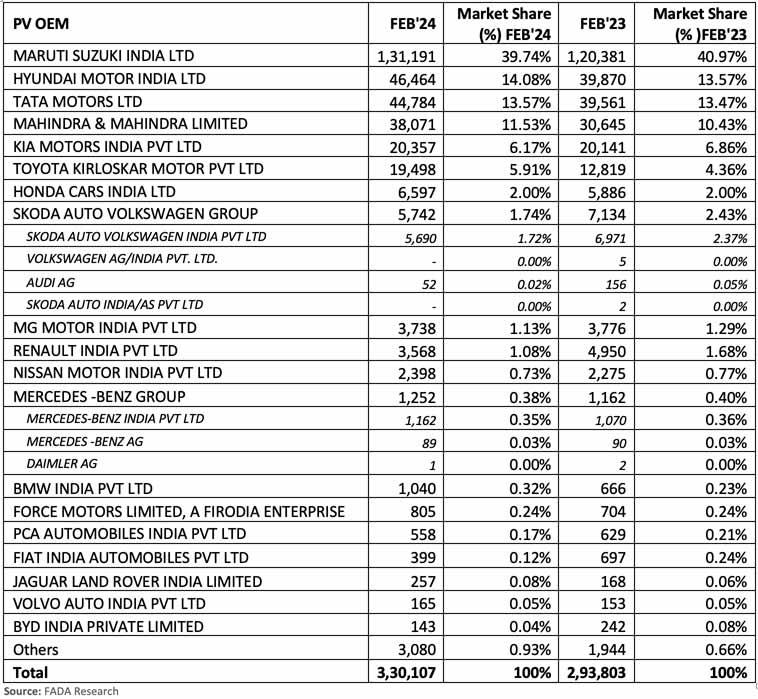

The Federation of Automobile Dealers Associations (FADA) has published February 2024 vehicle retail data, which shows an overall increase of just over 13% compared with February 2023 data. The Passenger Vehicle (PV) segment, in particular, sold a total of 3,30,107 units last month, registering a YoY growth of just over 12.3%. Tata Motors and Mahindra continue to hold their 3rd and 4th place, respectively, in the PV segment. Mahindra PV retailers sold over 17,700 units more than Kia last month, keeping the latter in the 5th place.

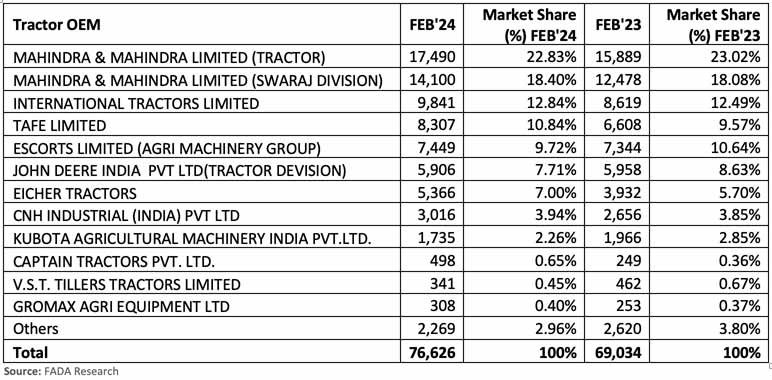

All the segments were in green last month, apparently due to the wedding season, and interestingly, the tractor segment also recorded a double-digit growth last month. But anyway, FADA President Manish Raj Singhania had the following to say:

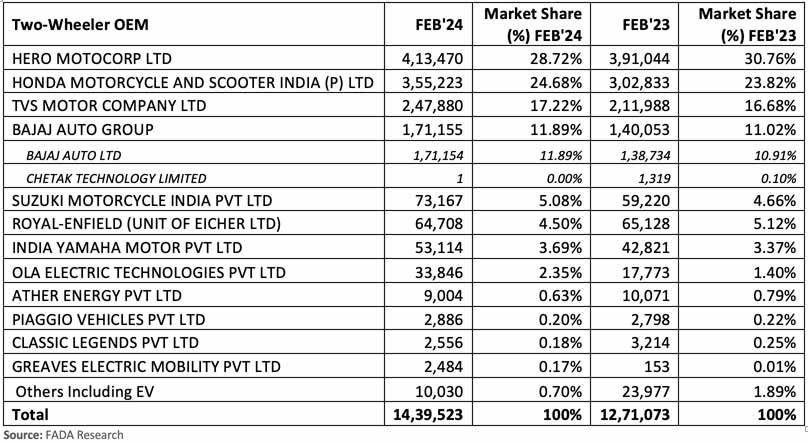

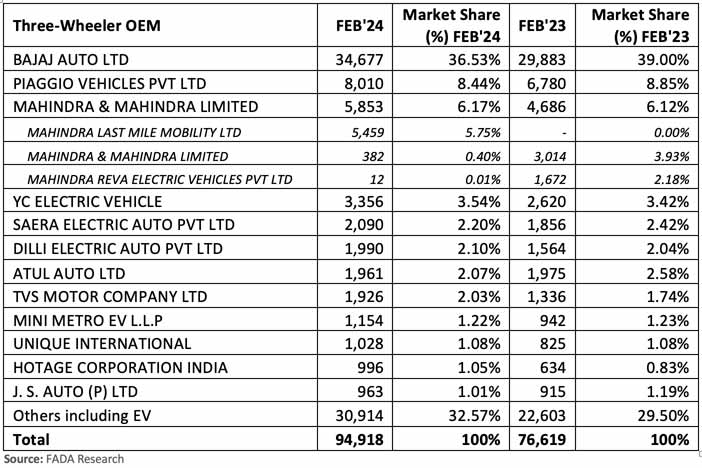

The two-wheeler market’s 13% YoY growth was driven by the rural sector, premium model demand, and strong entry-level segment performance, with broader product availability and compelling offers enhancing product acceptance. Factors like favorable marriage dates and improved economic conditions also contributed to this positive growth. The three-wheeler market surged by 24% YoY, with EVs making up 53% of this growth, fuelled by first-time users and a shift towards e-rickshaws, alongside better market sentiment and consumer engagement.

The PV segment has exhibited an impressive 12% YoY growth, achieving the highest sales figures ever recorded for the month of February. This upward trajectory was propelled by the strategic introduction of new products and enhanced vehicle availability. While the sector benefits from favorable customer sentiment and the successful introduction of models in high demand, the persistently elevated inventory levels, remaining at 50-55 days, present a significant concern. It is imperative for PV OEMs to undertake adjustments in production to mitigate these high inventory levels, thereby reducing the financial burden of carrying costs on dealers as it is vital for maintaining the financial health of dealers.

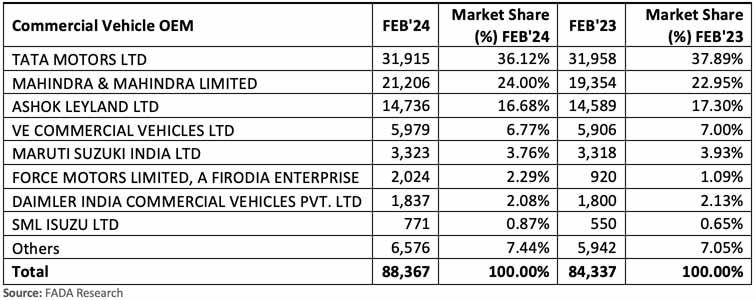

The CV segment grew by 5% YoY, overcoming challenges through fleet purchases and school buses, strong sectoral demand and improved financing, despite obstacles like cash flow shortages and election-related purchase deferrals, highlighting the sector’s resilience and gradual recovery.

OEM-wise market share data for February 2024 with YoY comparison:

Leave a Reply

Note: Comments that are unrelated to the post above get automatically filtered into the trash bin.