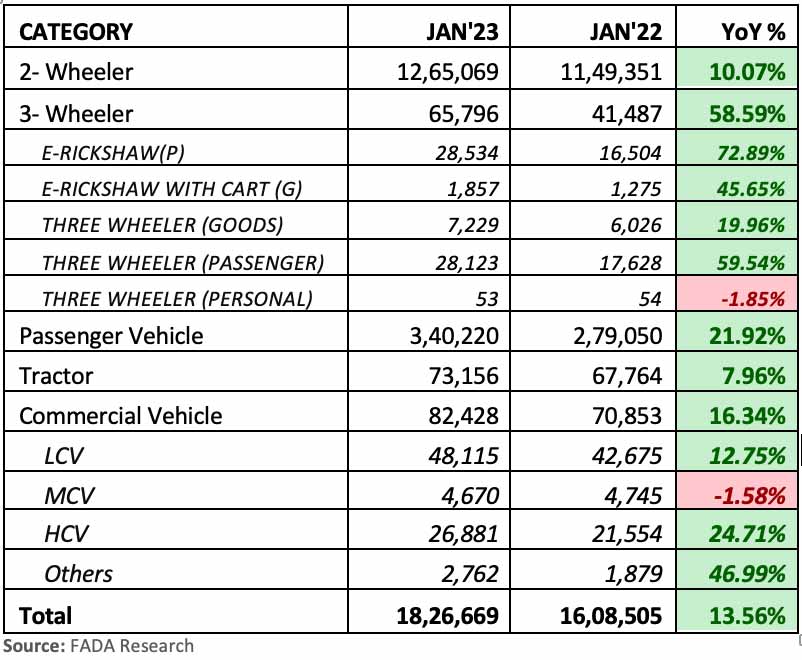

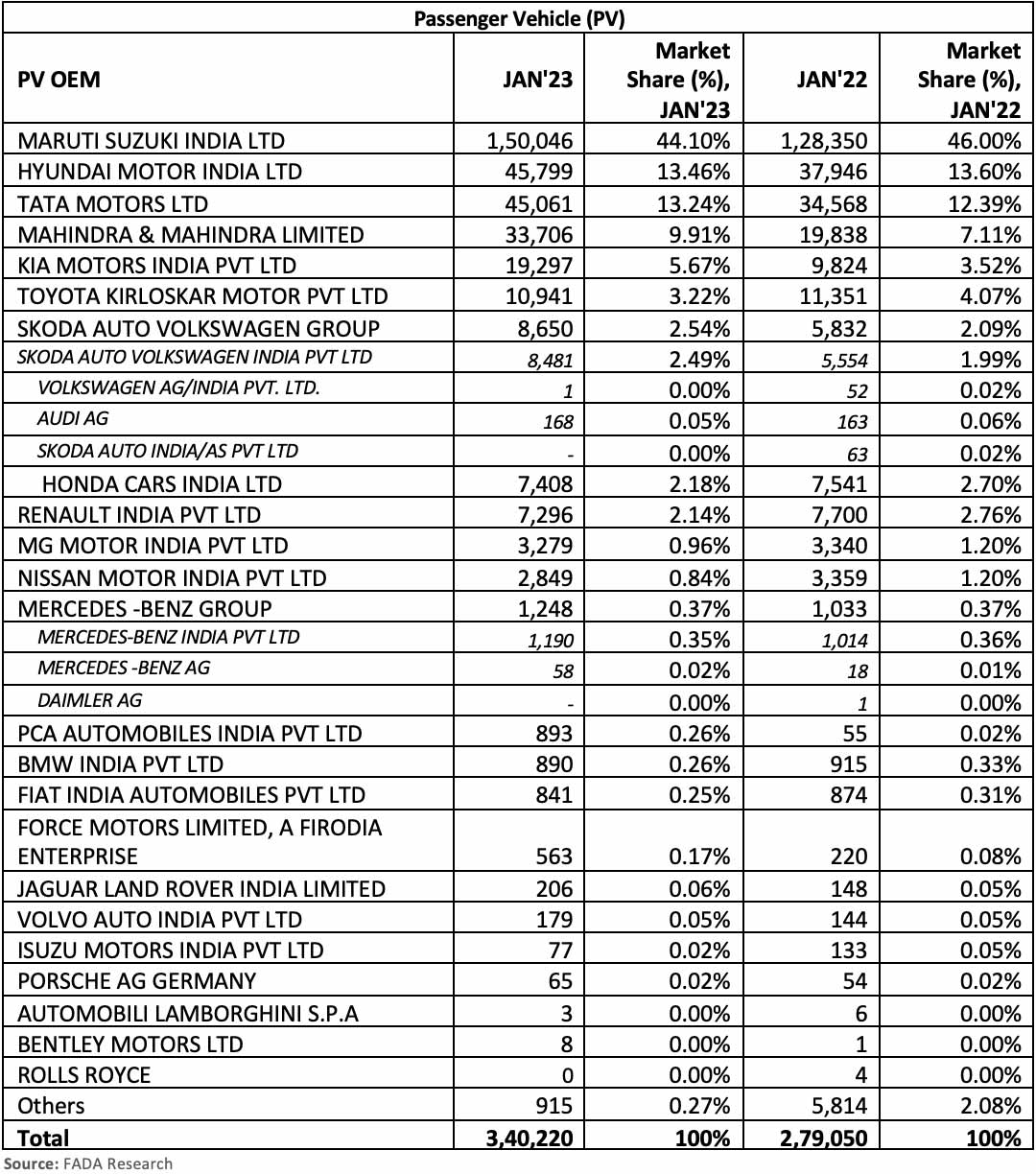

The Federation of Automobile Dealers Associations (FADA) has published January 2023 vehicle retail data, which shows an overall growth of just over 13.5% compared with January 2022 data. The Passenger Vehicle (PV) segment, in particular, registered a YoY growth of nearly 22% last month. Tata Motors and Mahindra continue to hold their 3rd and 4th place, respectively, in the PV segment. Mahindra dealers retailed over 14,400 PVs more than Kia last month, keeping the latter in 5th place.

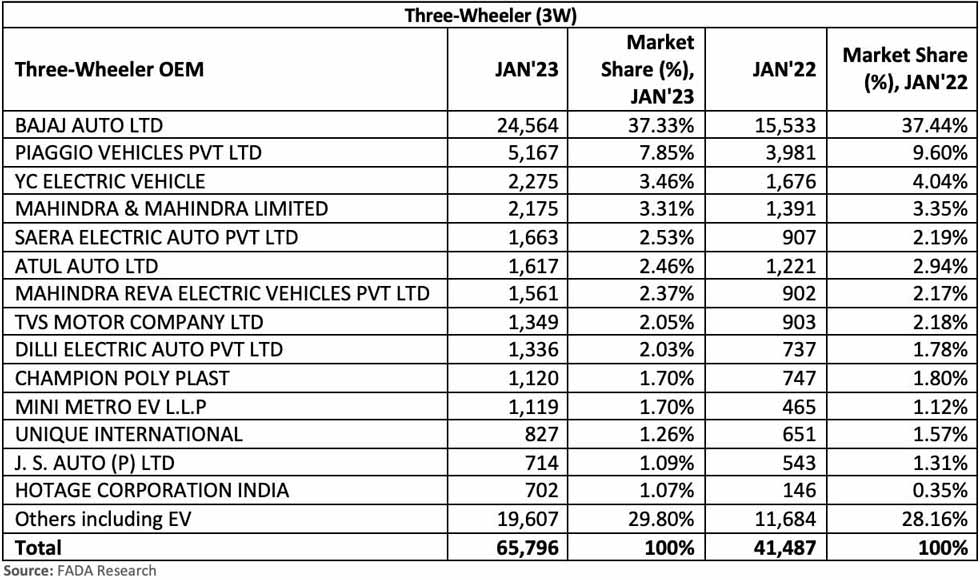

Pretty much every segment was in green with a double-digit YoY growth last month. The three-wheeler segment, in particular, registered just over 58.5% growth in Jan 2023, thanks to the continued growth of e-commerce businesses. FADA President Manish Raj Singhania had the following to say:

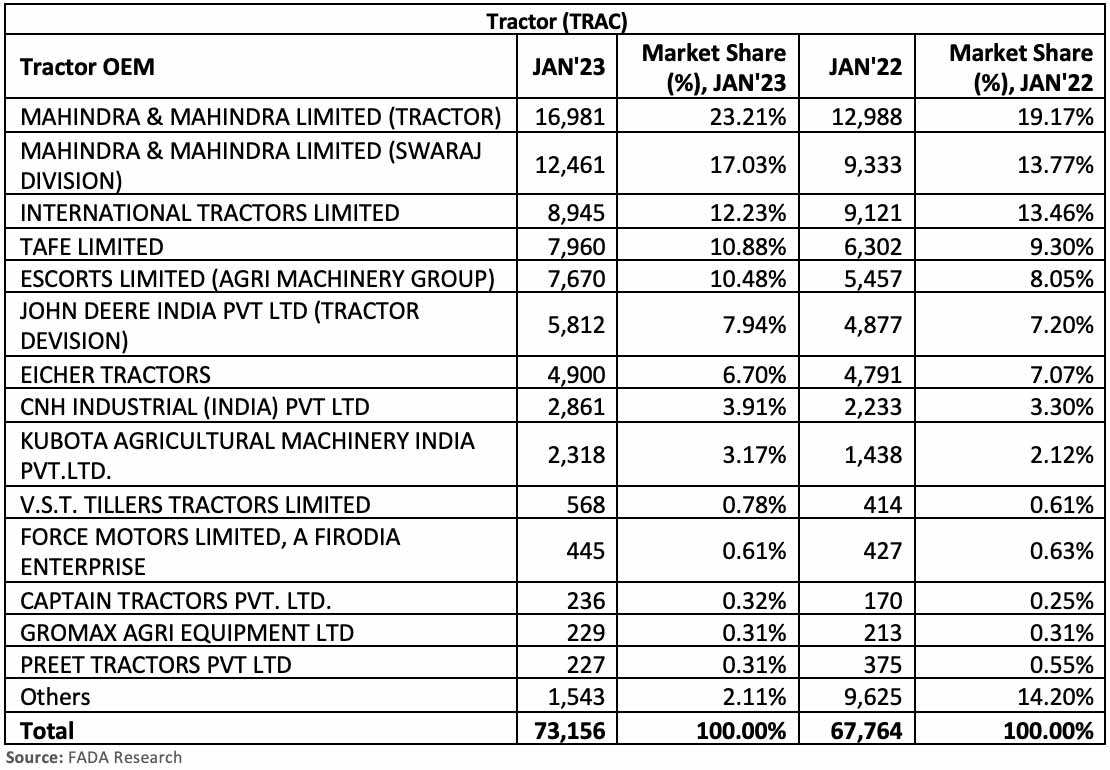

January 2023 witnessed total retail rising by 14% YoY but was still down by 8%, when compared with the pre-covid month of January 2020. All categories were in green with 2-wheeler, 3-wheeler, Passenger Vehicle, Tractor and Commercial Vehicles growing by 10%, 59%, 22%, 8% and 16%, respectively, on a YoY basis.

The 2-wheeler category showed a growth of 10% YoY but when compared with 2021 and the pre-covid month of January 2020, it continued to see pressure as the same fell by 7% and 13%. While sentiments are improving at a snail’s pace and are better than what it was a year ago, the rural market is yet to fully come to the party as the cost of ownership has shot up significantly while disposable income has not increased in the same ratio. The 3-wheeler segment has seen 60% growth YoY, 101% growth when compared with 2021 and is now slightly down by a mere 3% when compared to pre-pandemic levels in January 2020. EV fame-2 subsidy along with the demand from commercial 3W space is fuelling healthy growth.

The Passenger Vehicle segment continues to perform well with growth of 22% YoY, 10% from January 2021 and 8% from the pre-covid month of January 2020. While good enquiry, healthy bookings and improved supplies are helping aid this segment, it is the entry-level sub-segment that is still feeling the pinch. Apart from this, while the waiting period for some models has come down, SUVs and luxury vehicles continue to witness minimum waiting of 2-3 months.

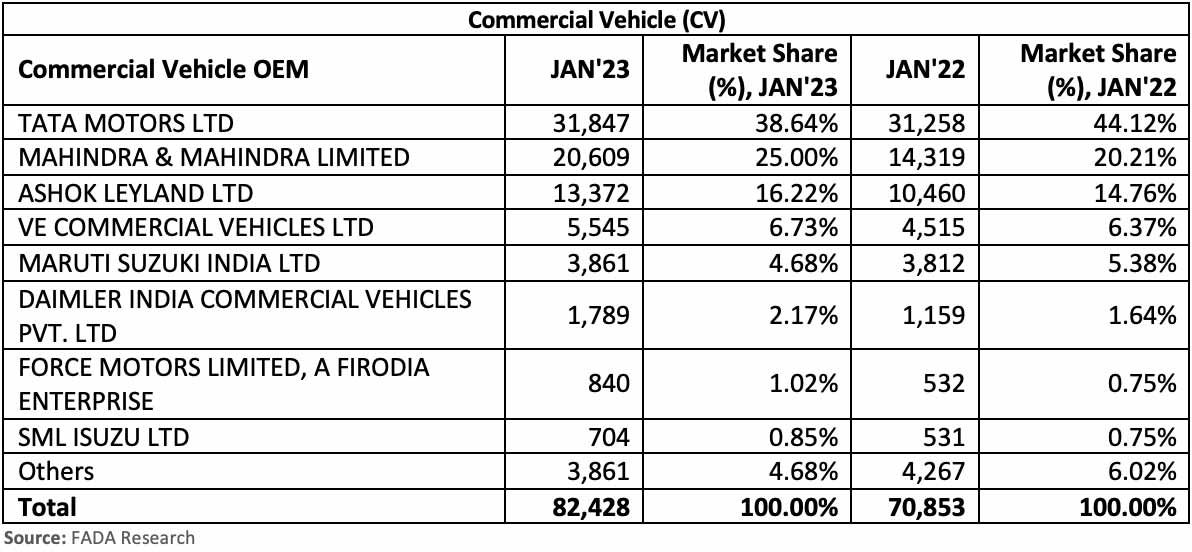

The Commercial Vehicle category has also shown robust growth by growing 16% YoY, 23% from January 2021 and 6% from the pre-covid month of January 2020. Continued demand in the market due to the replacement of fleet, growth in freight availability and the government’s consistent push for infrastructure projects has helped the CV segment rise above pre-covid numbers.

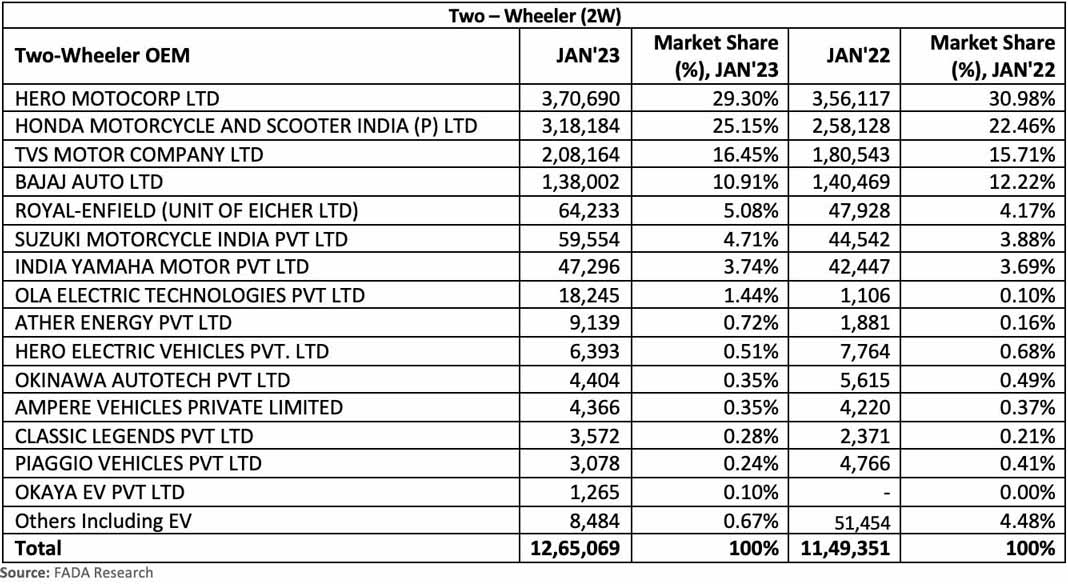

OEM-wise market share data for Jan 2023 with YoY comparison:

Leave a Reply

Note: Comments that are unrelated to the post above get automatically filtered into the trash bin.