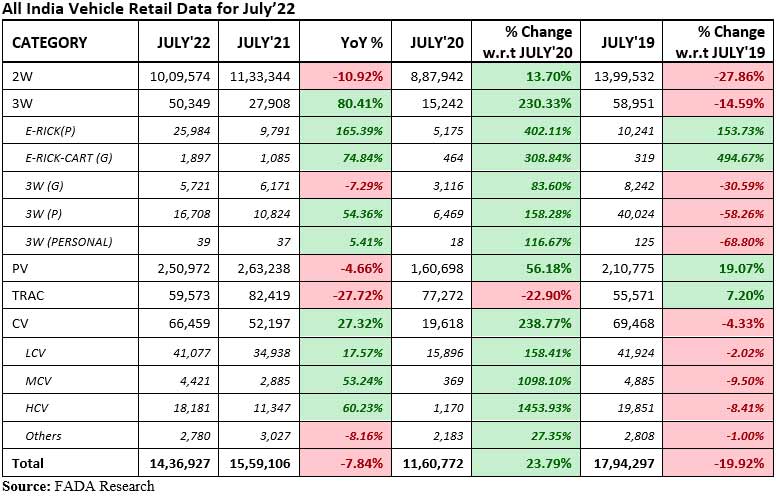

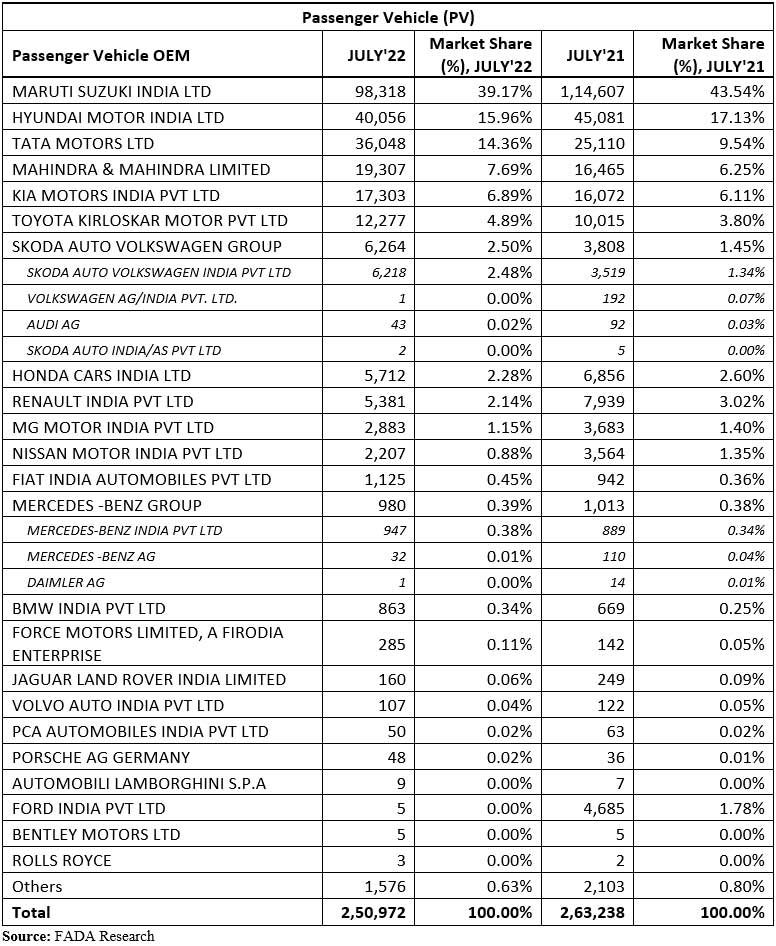

The Federation of Automobile Dealers Associations (FADA) has published July 2022 vehicle retail data, which shows an overall decline of nearly 8% compared with July 2021 data. The Passenger Vehicle segment retailed 2,50,972 units last month as opposed to 2,63,238 units during the same period last year, registering a decline of 4.66%. However, when you compare it to pre-Covid era (July 2019), there’s a growth of just over 19% in the PV segment. Tata Motors which had claimed second place in June 2022 in the PV segment, returned to third place in July 2022. Mahindra & Mahindra sold just over 2,000 PVs more than Kia, thereby retaining its 4th place last month.

The two wheeler and tractor segments recorded double-digit decline last month, while an 80% growth in the three wheeler segment is more of the sales going back to pre-Covid levels. But anyway, FADA President Vinkesh Gulati had the following to say –

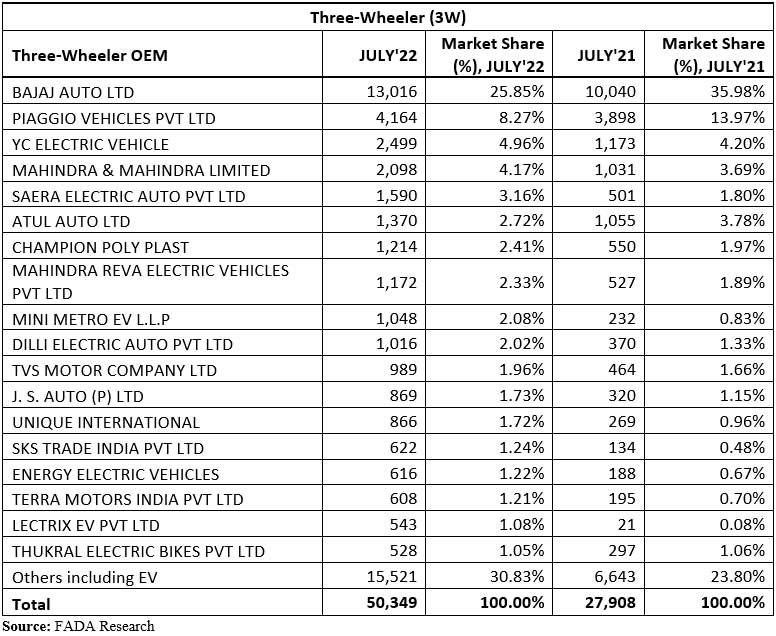

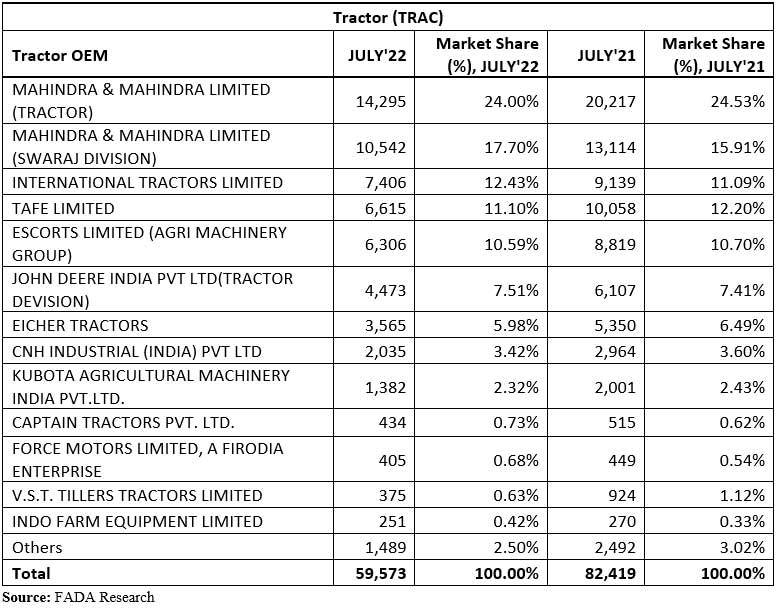

Continuing our quest of a deeper insight in auto retail figures, FADA for the first time has released 3W sub-segment retail figures. After breakup of the CV segment, the 3W sub-segmentation will help all the stake holders understand the 3W market in much detail. Auto retail for the month of July 2022 fell by 8%. July is generally considered as a lean month before festival season hits in August. When compared with July 2019, a pre-Covid month, total vehicle retails fell by 20%. PV and tractor continued to outperform by growing 19% and 7%, respectively. All the other categories were in red with 2W, 3W and CV falling by 28%, 15% and 4% respectively.

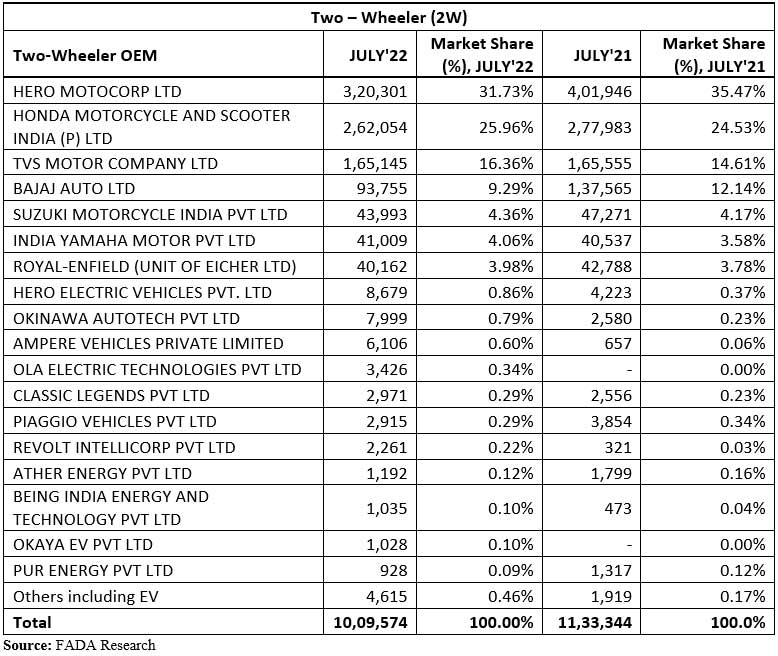

The 2W retail run witnessed poor demand as rural India continues to underperform. This coupled with high inflation, erratic monsoon and high cost of ownership continues to keep bottom of the pyramid customers at bay. The 3W space continued to see demand recovery even though full recovery to pre-Covid levels is still some time away. Digging deeper, it is clearly evident that e-rickshaws is the biggest mover in the segment. Demand recovery in 3W passenger category also shows that Covid is now behind us as passenger movement has once again started gaining traction.

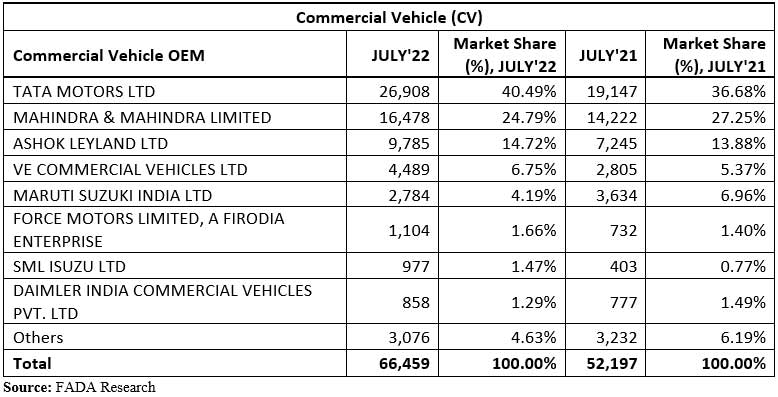

CV retail figures continue to witness good demand as government’s infrastructure push is helping customers in concluding their purchase. Apart from this, the bus segment also witnessed beginning of demand recovery as educational institutions and offices are once again back to normal mode.

OEM-wise market share data for July 2022 with YoY comparison:

Leave a Reply

Note: Comments that are unrelated to the post above get automatically filtered into the trash bin.